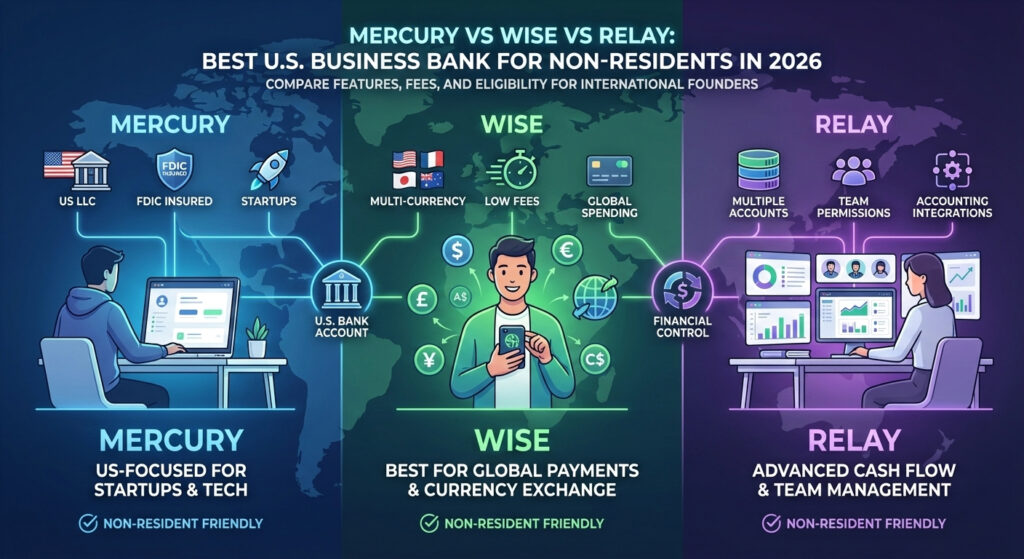

Mercury vs Wise vs Relay: Best U.S. Business Bank for Non Residents in 2026

Choosing the right U.S. business bank is one of the most important decisions for non resident founders. Even with a U.S. LLC and an EIN, the wrong bank can lead to delayed payments, rejected integrations, or future account reviews.

In 2026, three platforms dominate the market for non residents:

Mercury

Relay

Wise Business

Each one serves a different purpose. This guide compares them clearly so you can choose the best U.S. business bank for your situation.

Why Choosing the Right U.S. Bank Matters

For non residents, a U.S. business bank account is not just a place to store money. It directly affects:

PayPal and Stripe approval

Speed of withdrawals

Trust with platforms and clients

Compliance stability

Long term scalability

Payment processors look closely at where your money goes. A strong U.S. banking setup reduces holds and risk flags.

Mercury: Best Overall U.S. Business Bank for Non Residents

Mercury is the most popular choice among non resident founders in 2026.

Key advantages

Fully online application

No monthly fees

Strong Stripe and PayPal compatibility

Designed for startups and digital businesses

FDIC insured through partner banks

Requirements

U.S. LLC

EIN

Passport

Business website or description

U.S. registered agent and address

Best for

SaaS founders

Freelancers

Ecommerce sellers

Digital agencies

Mercury is ideal if you want a real U.S. banking experience without visiting the United States.

Relay: Best for Structure and Compliance

Relay focuses on financial organization and compliance. It is often preferred by businesses planning to scale.

Key advantages

Multiple checking accounts

Strong expense management

High compliance reputation

Clean interface for teams

Requirements

U.S. LLC

EIN

Verified business activity

Clear explanation of revenue sources

Best for

Agencies

Teams

Businesses with multiple income streams

Founders who want clean accounting

Relay is slightly stricter than Mercury but offers excellent long term stability.

Wise Business: Best for International Transfers

Wise Business is not a traditional U.S. bank, but it is still useful for non residents.

Key advantages

Easy international transfers

Multi currency accounts

Fast setup

Low conversion fees

Limitations

Not a full U.S. bank

Some platforms do not accept Wise

Not ideal as a primary account for Stripe or PayPal

Best for

International freelancers

Businesses with global suppliers

Secondary banking needs

Wise works best as a support account, not your main U.S. business bank.

Mercury vs Relay vs Wise: Quick Comparison

| Feature | Mercury | Relay | Wise |

|---|---|---|---|

| Fully U.S. bank | Yes | Yes | No |

| Non resident friendly | Yes | Yes | Yes |

| Stripe compatibility | Excellent | Excellent | Limited |

| PayPal compatibility | Excellent | Excellent | Sometimes |

| Multi currency | No | No | Yes |

| Best use | Primary bank | Scaling bank | Secondary bank |

Which One Should You Choose in 2026

Choose Mercury if:

You want fast approval

You run an online business

You use Stripe or PayPal

You want simplicity

Choose Relay if:

You manage multiple accounts

You want strong compliance

You plan to scale seriously

Choose Wise if:

You need international transfers

You already have a U.S. bank

You want lower currency fees

Many non residents use Mercury or Relay as the main bank and Wise as a secondary option.

How a U.S. LLC Improves Bank Approval

Banks do not approve individuals. They approve structured businesses.

A properly formed U.S. LLC:

Matches U.S. banking rules

Reduces compliance risk

Improves payment gateway trust

Prevents sudden account closures

This is why most payment problems start with weak structure, not the bank itself.

Final Advice for Non Residents

Do not choose a bank randomly.

In 2026, the safest setup looks like this:

U.S. LLC

EIN

Mercury or Relay as primary bank

Wise for international transfers if needed

This structure supports growth, reduces risk, and keeps your money accessible.