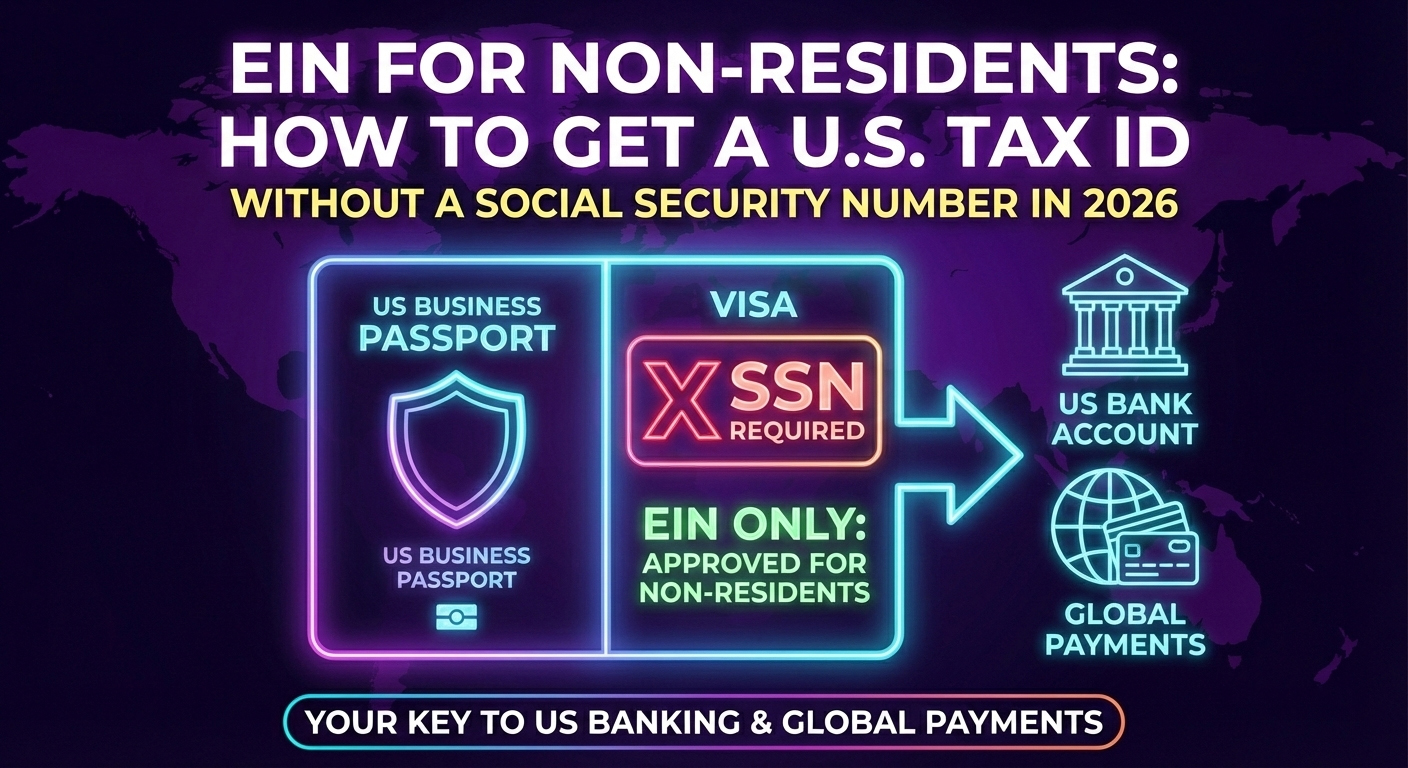

EIN for Non-US Residents: How to Get a U.S. Tax ID Without an SSN (2026)

EIN for non-US residents is possible in 2026 even if you don’t have a Social Security Number (SSN). An EIN is the […]

Do Non Residents Pay U.S. Taxes on an LLC What You Must Know in 2026

Taxes are the biggest source of fear for non resident founders forming a U.S. LLC. Many delay or avoid registering simply because […]

Why Payment Gateways Reject Non U.S. Businesses and How to Fix It in 2026

One of the most frustrating moments for non U.S. founders is getting rejected by a payment gateway after doing everything right. Stripe […]

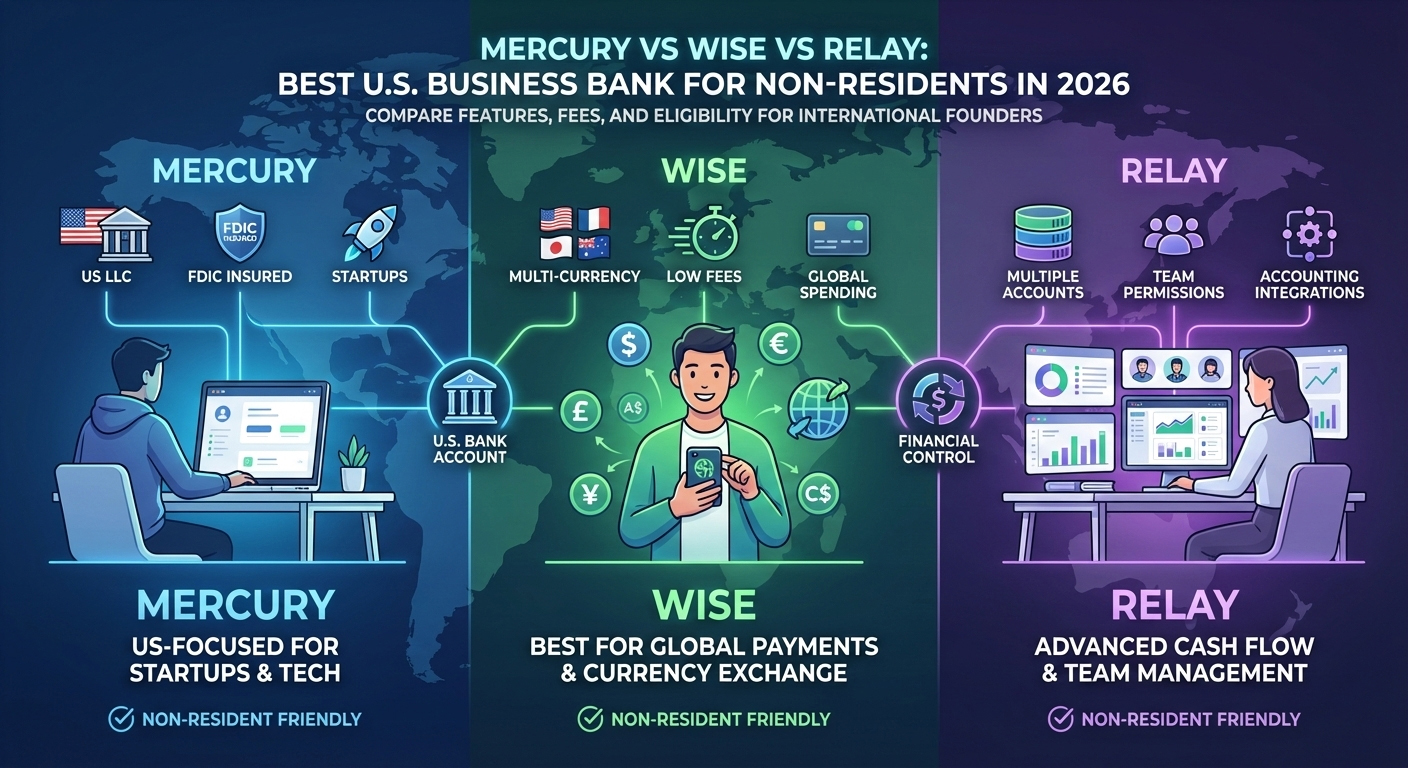

Mercury vs Wise vs Relay: Best U.S. Business Bank for Non Residents in 2026

Choosing the right U.S. business bank is one of the most important decisions for non resident founders. Even with a U.S. LLC […]

U.S. Business Bank Account for Non-Residents: What You Need in 2026

For non-U.S. entrepreneurs, freelancers, and online business owners, opening a U.S. business bank account is often the missing link between making sales […]

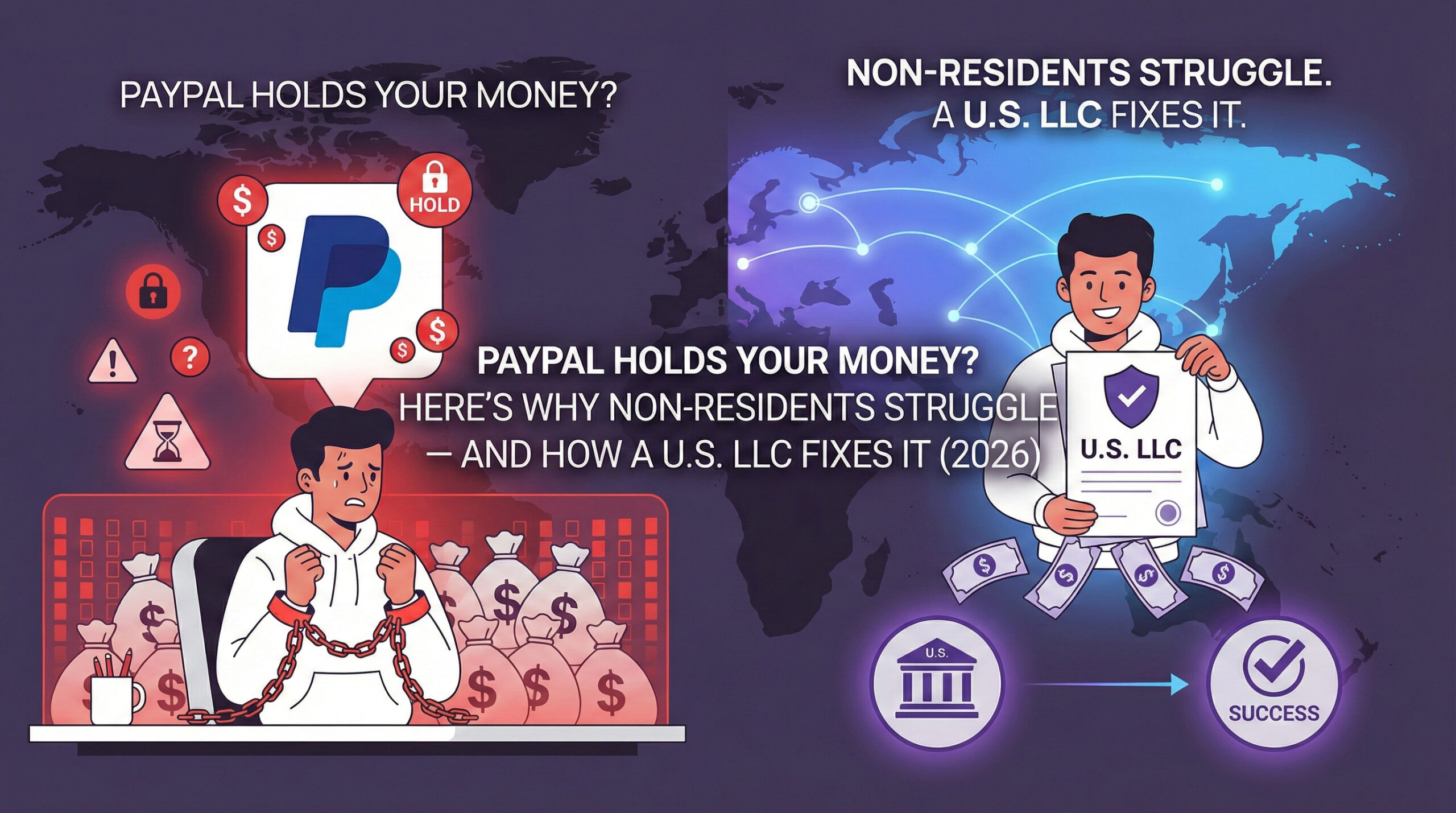

PayPal Holds Your Money? Here’s Why Non-Residents Struggle and How a U.S. LLC Fixes It (2026)

PayPal is one of the most trusted payment platforms in the world — yet for non-resident entrepreneurs, it is also one of […]

Why Stripe Suspends Accounts and How a U.S. LLC Prevents It (2026 Guide)

Stripe is one of the most powerful payment platforms in the world. Yet every day, freelancers, dropshippers, and digital entrepreneurs wake up […]

What an EIN Unlocks: The Real Gateway to Global Business

For entrepreneurs outside the United States, one of the biggest challenges isn’t talent, ideas, or ambition — it’s access. Access to global […]

The Ultimate Guide: How to Start a U.S. LLC for Non-Residents in 2026

If you are a freelancer, dropshipper, or digital entrepreneur, you’ve likely realized that the biggest hurdle to “going global” isn’t your product—it’s […]